The Art of Crypto Arbitrage: Strategies, Challenges, and Solutions

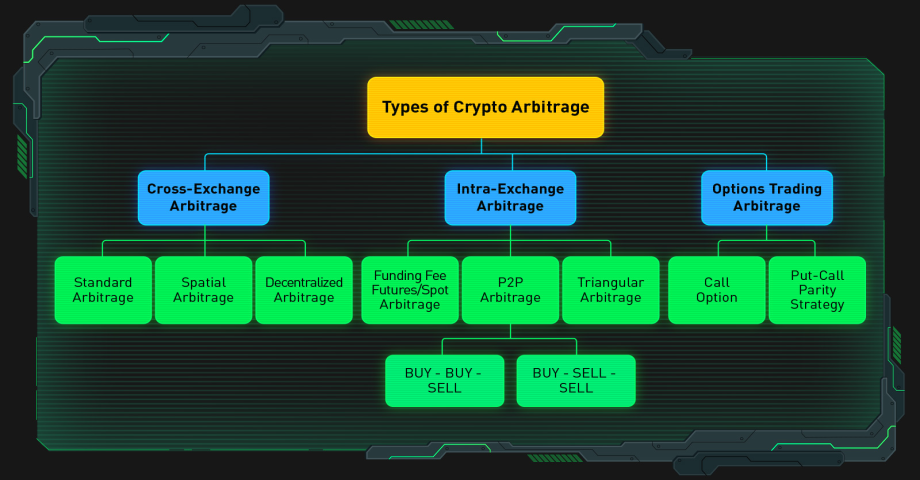

In my most recent musings on arbitrage trading, a topic I began unravelling in my last piece, I find myself with more time to indulge in reading, thanks to my current vacation in Greece. During this time, I stumbled upon two articles that I feel compelled to share with you.The first is by Annabelle Darcie, who delves into the nuances of arbitrage strategies, effectively categorising this type of trading into three primary forms:1. Spatial Arbitrage: This involves simultaneously capitalising on price discrepancies for the same cryptocurrency across different exchanges. Traders purchase the asset on the exchange where it’s priced lower and sell it where the price is higher, thereby profiting from the spread.2. Temporal Arbitrage: This strategy exploits price variations for the same cryptocurrency within the same exchange but at different times. Traders benefit from the temporal price gap by buying low and selling high.3. Cross-Exchange Arbitrage: Traders take advantage of price differences by conducting trades across various exchanges. The asset is bought on one exchange and sold on another at a higher price, yielding profit from the price differential.Naturally, building an arbitrage bot is a challenging feat. Beyond the algorithm, one must integrate various platforms for movement, devise a strategy, and so on. Linda Flowers’ article could assist here, mentioning companies that develop such bots.Revisiting Annabelle’s article, she outlines four challenges:1. Market VolatilityThe overarching landscape is unaffected by the current value of cryptocurrency — discrepancies between exchanges persist whether the market is booming or busting. Consider the recent surge in Bitcoin’s value to $60,000, down from $72–73,000 just days before. Volatility becomes critical when a downturn occurs just as we’ve made a purchase, intending to sell on another exchange.2. Transaction CostsOften overlooked by those eager to dive into arbitrage, the cost (not to mention the time) of transferring BTC or ETH is non-negligible. Yet, for transactions involving significant sums, such as a million dollars in Ether, a $15 transfer fee may sting less. This leads us to a crucial aspect — the substantial capital required for arbitrage trading. Remember the Bitcoin example from my previous piece, where we earned $100 on a $67,000 investment? It underscores the need for considerable funds.3. Liquidity IssuesImagine your bot is ready to trade. Still, you need more funds on the exchange offering the lower price (perhaps you’ve already sold and bought elsewhere or transferred funds). This invisible ceiling can thwart your trading success. Where will the money come from?4. Regulatory ConsiderationsEntering a new chapter altogether, it’s worth noting the legal landscape, especially for someone like me, a resident of the United Kingdom. Despite being an EU citizen, UK regulations apply to me — for instance, the UK’s recent actions against Binance. I have access to fewer services than non-UK residents, highlighting the importance of where you intend to operate your trading bots.So what to do?This discussion highlights that while opportunities exist to develop trading bots for those inclined, many turn to companies that offer such services. However, this introduces new challenges. I need more patience for such endeavours and, despite my enthusiasm for learning new things, cannot compete with professionals who build and configure arbitrage bots daily. I am searching for an off-the-shelf solution, which I have found and will be the focus of my next piece.